My role

- Design research

- Journey mapping

- PRD revisit

- Design Spec docs

- User interview

- UI/UX design

- Prototypes

- Micro Interactions

- Handoff & DQA

Year

2022 – 2023

I have worked in razorpay for around a quarter and have worked in the following projects:

- Solving Bulk payouts on mobile

- Vendor payments

- Biometric login

- Money movements, Insights & frameworks

RazorpayX mobile

Building neo banking features for the budding startups, the users for the mobile are primarily founders and finance head who have an on the go use case, and want selective features sets.

Problem statement

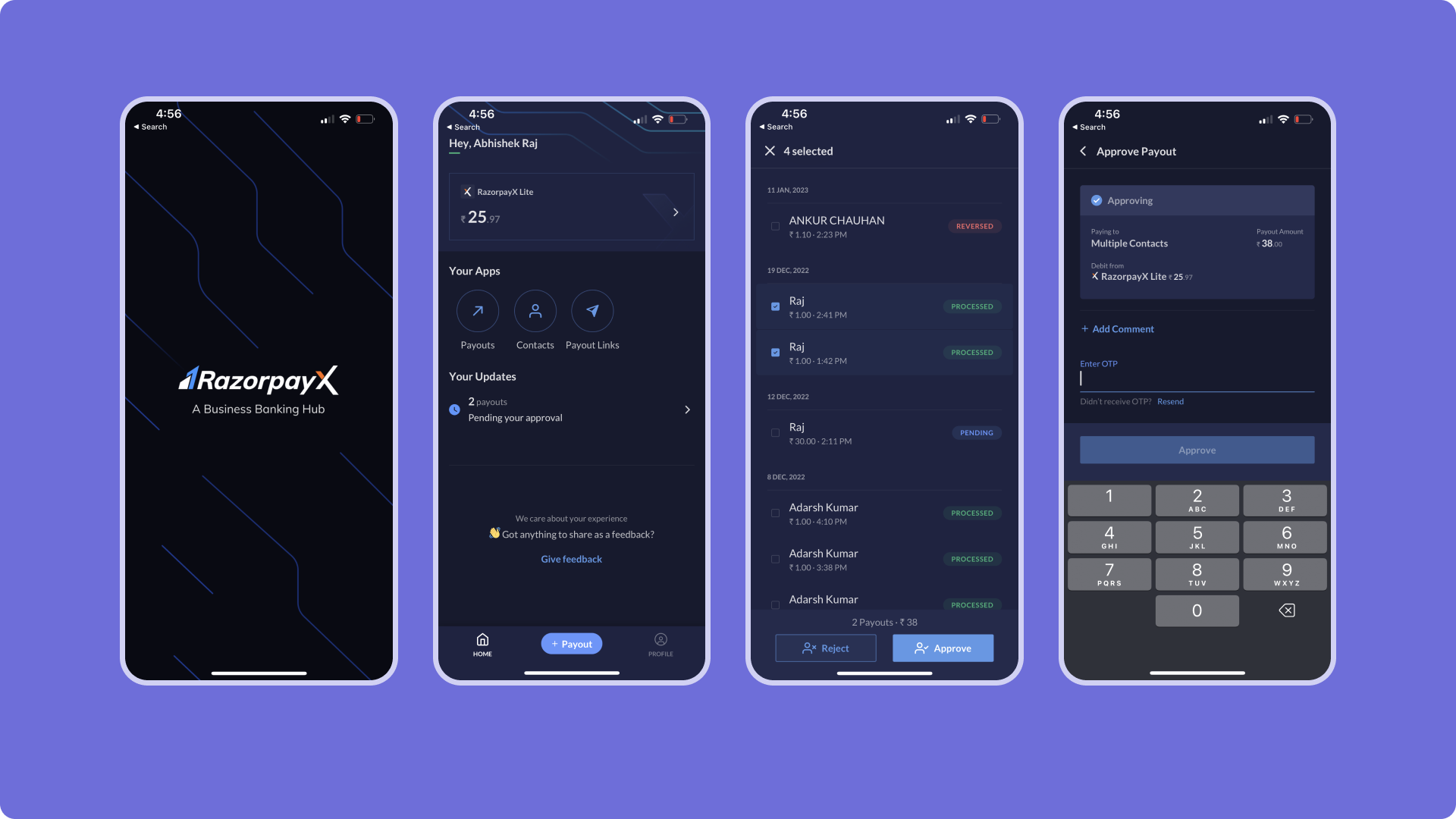

Most vendor payment is done by small businesses on X i.e. S2 segment. They also are aligned well with the mobile user segment i.e. small businesses who create < 500 payouts in a month. The payments are handled by the founder or a one-person finance team. The number of vendors is likely less than 25 for most users in a month. The needs revolve around their user stories like:

- Need to make a payout approval

- Need to make a vendor payment

- Need to check insights of payouts

- etc

Solution

Introducing features and tools that can be designed around on the go use case thus helping build features for our main users.

Vendor Payments

What

Vendor payments/accounts payable/invoice to pay is the process of paying vendors for goods or services rendered on credit (accounts payable). This process can start as early as sourcing vendors to procurement to fulfillment, and invoicing and ends with payment and reconciliation. This has been available on the X dashboard since ~1.5 years ago.

Why

The intent of bringing vendor payments on mobile app is to give small merchants an effective on the go mechanism to pay their vendors and bring the additional flexibility that mobile device brings, such as uploading invoice, sharing payouts status, view vendor details while approving etc. New MTU potential on app: Vendor pay has 600+ MTU already, out of which 375 are SME users. It gets ~80 new MTU added every month. Differentiation of the app in the market. no other app supports invoice-to-vendor payment journey

Flow

Success

More people choosing mobile to making vendor payments

- No. of vendor payout approved from the app after 30 days of launch

- No. of vendor payout merchant on the app after 30 days of launch

- New vendor payment created on the app after 30 days of launch

- % of new vendor payout users on X use the mobile app within 30 days of activation (for SME)

This project led to more people using payouts from vendor invoices payouts and brought more than 2x increase in mobile payouts thus affecting acquisition of new people, engagement for existing users

Money Movements

What

Currently looking at mobile app, Users have to scout in different places for different features, we understand that the user wants data in a concise manner which shows us what needs to be done and helps them achieve their task quickly, give them insights and notify when there are alerts

Why

- The intent with this is to provide users with focussed action items, JTBDs, which reduces their time and effort usually they would have spent in figuring out what/when/where tos of those items.

User Story

- Verify and approve payouts that are pending on user

- Make timely payments to invoices that are due or overdue or partially paid

- Make timely payments by ensuring sufficient balance to avoid payouts queuing or failure

- Take action on failed payouts if reason is user controllable

Problems

- Important information is not presented to users in a clear manner on the app. Without this information, the user has to remember what to do or scout for details in different places.

- Even on the dashboard, information on action points has become cluttered (check the left menu).

- Owner is a busy person and we want a place where they come to see what requires their attention first so that we help them save time.

- Increase the frequency for users so that they repeatedly come to the app. Currently, we have only pending payout for your approval built on the app, which is mostly focused on the finance persona.

Impact to users

- Increase productivity of merchants users: Helps prioritize and organize their banking tasks with minimal effort and time being spent

- Improves memory and reduces stress/anxiety: Helps declutter users banking tasks without being overwhelmed by too many things to do. Reduces uncertainty by reminding users what are the priorities and keeping track of tasks - day, week, month basis.Eg: Reduces anxiety among founders about payment dues etc

- Provides a sense of accomplishment: Completing tasks from a list of items can provide users a sense of accomplishment

- Allow merchants to use data insights

Success goals

- Repeat login on the app by Owner/Admin/Finance should increase by 5% post a month from launch increasing frequency and stickyness due to ease of usage.

- The no of actions done via app (in Your Updates) for pending action items to be increased by XX% after 60 days of launch

- Increase retention of users as the mobile app becomes easier to use (check impact to users)

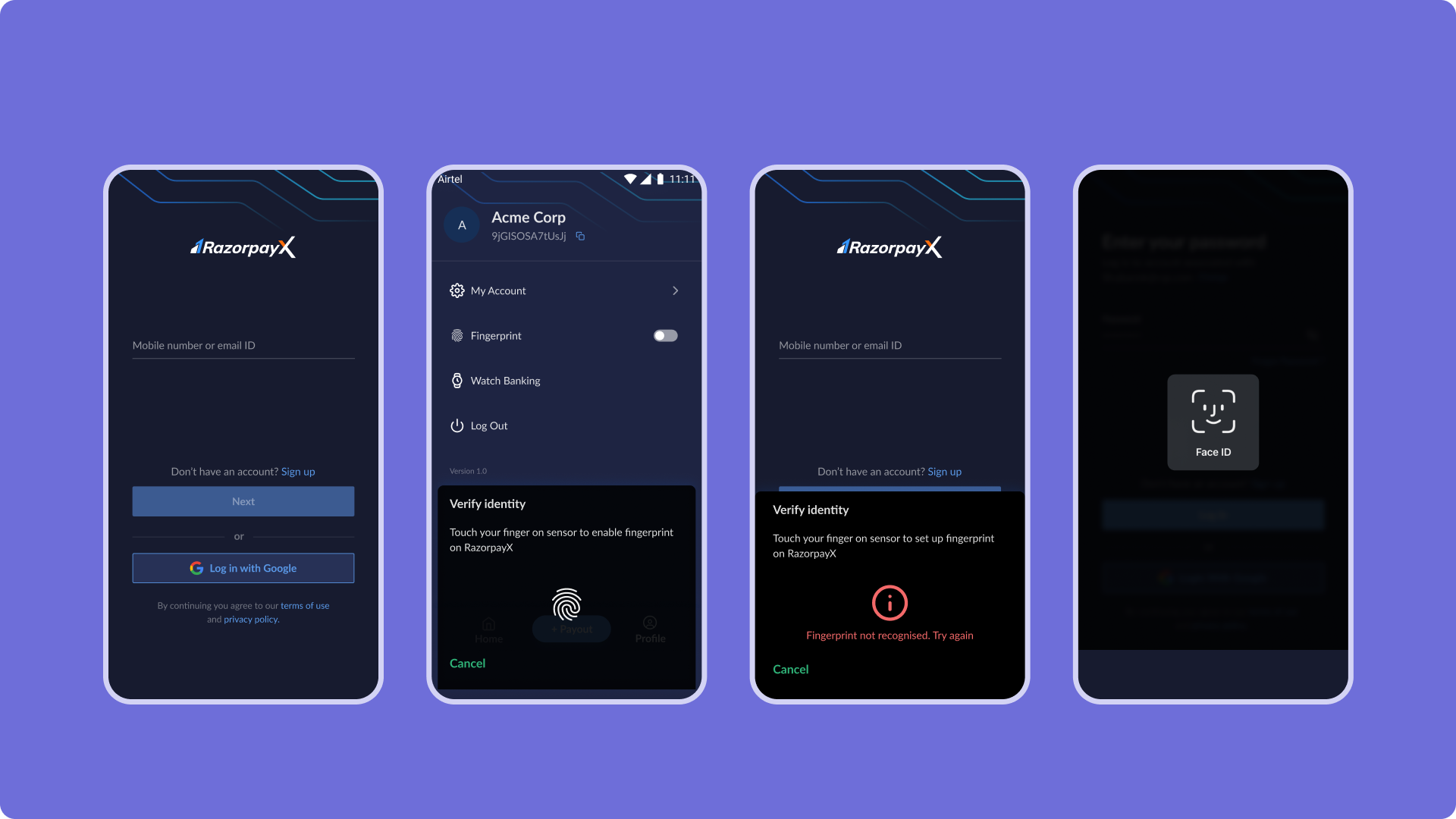

Biometric Login

Introduce a new way to login with biometric (face + fingerprint) logging in thus helping with the mobile goals of speed and delight

Bulk Payouts

Making bulk payouts for helping build faster payouts approvals for 'payouts via bank', 'payouts via virtual account' or 'combined' use cases